Loading

Get The Internal Revenue Service Requires A Doctors Statement Be Provided For Certain Healthcare

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Internal Revenue Service requires a doctor's statement online

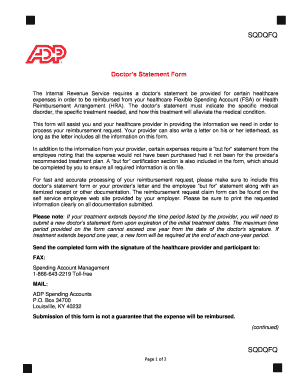

Filling out the Internal Revenue Service doctor’s statement form is essential for certain healthcare expenses to ensure reimbursement from your flexible spending account or health reimbursement arrangement. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the doctor's statement form.

- Press the ‘Get Form’ button to access the doctor’s statement form and open it for editing.

- Begin by entering your participant ID, alternate ID, or social security number along with your name and phone number in the appropriate fields. Ensure that the information is accurate and clearly written.

- Next, provide the employer's name in the designated section to assist with verification of your employment.

- If applicable, include the reference ID provided by ADP in the optional section.

- In the section for provider information, your healthcare provider should input the patient's name and recommended treatment, ensuring detailed descriptions are provided.

- Your provider must also include the CPT code, diagnosis code (if any), treatment start date, and duration for which the treatment is required.

- The provider's details must be completed, including their name, title, address, and signature along with the date to validate the form.

- Next, you need to fill out the employee certification section. By signing here, you certify that the expense would not have been incurred without your provider's recommendation.

- Make sure to include your signature, printed name, and the date in the provided fields.

- Once all information is accurately filled in, you may save changes, download, print, or share the completed form as needed for submission.

Complete your doctor's statement form online today to ensure prompt processing of your reimbursement request.

This IRS requires that you have a receipt or statement showing that you paid for the medical expense. The explanation of benefits from the insurance company showing your payment responsibility does not prove that you paid it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.