Loading

Get Investment Declaration Guide - Form 12bb How To Fill Form 12bb...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Investment Declaration Guide - Form 12BB online

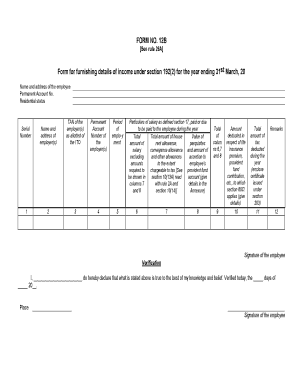

Filling out the Investment Declaration Guide - Form 12BB accurately is essential for effective income tax filing. This guide will help you navigate each section of the form, ensuring you carefully complete every required field online.

Follow the steps to successfully complete Form 12BB.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in the name and address of the employee in the designated fields at the top of the form. Additionally, include the Permanent Account Number (PAN) and the employee's residential status.

- Provide the name and address of the employer in the next section, along with the Tax Deduction and Collection Account Number (TAN) assigned to the employer.

- Input the Permanent Account Number of the employer in the corresponding field.

- Indicate the period of employment by entering the start and end dates for the employment year.

- In the section labeled 'Particulars of salary,' enter the total salary and any allowances, including house rent allowance, conveyance allowance, and other perquisites, in the specified columns.

- Calculate the total amounts from the salary and perquisites, recording them in the appropriate fields. Ensure accuracy as these figures will impact tax calculations.

- List any deductible amounts concerning life insurance premiums and provident fund contributions, providing detailed breakdowns if necessary.

- Document the total amount of tax deducted during the year. Do not forget to attach any supporting certificates issued regarding tax deduction.

- Review the remarks section for any additional notes that you may need to include.

- Provide your signature in the verification section, along with the date and place of signing. Ensure that the declaration is accurate to the best of your knowledge.

- After completing the form, save your changes. You can choose to download it for your records, print it, or share it as needed.

Begin filling out your Form 12BB online now to ensure timely and accurate submission.

Form 12BB is a statement of claims by an employee for deduction of tax. With effect from 1st June 2016, a salaried employee is required to submit Form 12BB to his or her employee to claim tax benefits or rebates on investments and expenses. Form 12BB has to be submitted at the end of the financial year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.