Loading

Get Cdtfa 531 A2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cdtfa 531 A2 online

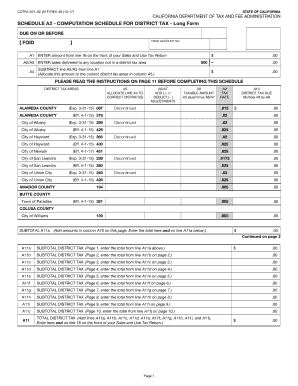

The Cdtfa 531 A2 form, also known as the Schedule A2 - Computation Schedule for District Tax, is critical for accurately reporting district taxes to the California Department of Tax and Fee Administration. This guide will provide you with clear, step-by-step instructions for completing the form online.

Follow the steps to successfully complete the Cdtfa 531 A2 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the amount from line 16 on the front of your Sales and Use Tax Return in box A1.

- Input sales delivered to locations not in a district tax area in box A2/A3.

- Subtract the total entered in box A2/A3 from the amount in box A1 and input the result in box A4.

- Allocate the amount from box A4 to the correct district tax areas in column A5.

- If applicable, enter any add (A6) or deduct (A7) adjustments in columns A6/A7.

- Calculate the taxable amount by adding or subtracting values in columns A5, A6, and A7, and enter the result in A8.

- Input the tax rate for each district in A9.

- Multiply the amount in A8 by the tax rate in A9 to get the district tax due for each entry and enter the results in A10.

- Summarize your subtotal in lines A11a through A11j for the totals on each page and enter the grand total on line A11.

Complete your Cdtfa 531 A2 form online today to ensure your district tax obligations are met.

CDTFA - CA Department of Tax and Fee Administration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.