Loading

Get Cdtfa-531-ae1 (s1f) Rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CDTFA-531-AE1 (S1F) REV online

This guide provides a clear and supportive walkthrough for completing the CDTFA-531-AE1 (S1F) REV online. Whether you are experienced with digital forms or new to the process, this resource will help you navigate each section effectively.

Follow the steps to fill out the CDTFA-531-AE1 (S1F) REV online.

- Press the ‘Get Form’ button to obtain the form and open it in your digital editor.

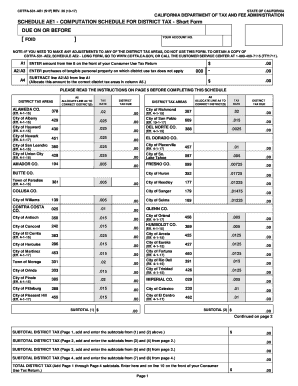

- In Box A1, enter the amount from line 8 on the front of your Consumer Use Tax Return. This value represents your total taxable sales.

- In Boxes A2 and A3, enter the total purchases of tangible personal property on which district use tax does not apply. This will help you calculate the net amount subject to tax.

- Subtract the amounts entered in A2 and A3 from the amount in A1 and enter this result in Box A4. If this is $0.00, you are finished with your Schedule AE1.

- Using the amount in Box A4, allocate it to the correct district tax areas in Box A5. Make sure to adhere to the specific tax rates indicated for each district.

- Now, calculate the District Tax Due for each district by multiplying the amount allocated to each district by the respective tax rate. Enter these results in the 'District Tax Due' column.

- Sum the subtotals from each page of the schedule, adding values for designated districts, and enter these in the subtotal boxes.

- Finally, add all subtotals across all pages to determine the Total District Tax. This total should be entered on line 10 of your Consumer Use Tax Return.

Complete your documentation online to ensure timely and accurate processing.

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.