Loading

Get Application For Postponement Or Open Market Option (ulip)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR POSTPONEMENT OR OPEN MARKET OPTION (ULIP) online

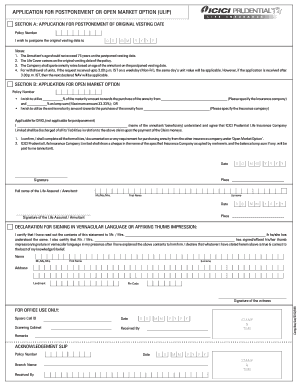

This guide provides a comprehensive walkthrough for users looking to fill out the Application for Postponement or Open Market Option (ULIP) online. Whether you are postponing your original vesting date or opting for an open market option, these detailed instructions will assist you in successfully completing the form.

Follow the steps to complete the ULIP form accurately and efficiently.

- Press the ‘Get Form’ button to access the application form and open it in your document editor.

- In Section A, enter your policy number in the designated field. Below, specify the new original vesting date by providing the day, month, and year in the appropriate fields. Ensure that the annuitant’s age does not exceed 75 years on this new date, as this is a crucial eligibility condition.

- In Section B, again enter your policy number. Decide how you wish to allocate the maturity amount: specify the percentage you want to use for purchasing an annuity from a selected insurance company and the percentage you want to receive as a lump sum. Remember, you can claim up to a maximum of 33.33% as a lump sum. This section also requires you to acknowledge your understanding of the company’s liability upon payment of the claim amounts by signing your name.

- Include the date of filling the form and provide your signature. Additionally, indicate the place where you are submitting the application.

- If applicable, include a declaration for signing in vernacular language or affixing a thumb impression. Populate your name, address, and other required details in this section to verify the signing process was explained to you in your preferred language.

- Finally, ensure all sections are completed accurately before saving your changes. You can then choose to download, print, or share the completed form as needed.

Complete your Application for Postponement or Open Market Option online today.

18. Lock-in-Period means the period of five consecutive years from the date of commencement of the Policy, during which period the proceeds of the discontinued policy cannot be paid by Us, except in the case of death of the Life Assured. 19.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.