Loading

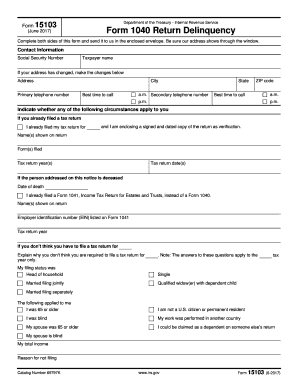

Get Form 1040 Return Delinquency

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1040 Return Delinquency online

Filing the Form 1040 Return Delinquency online is an important step for users who have received a notice regarding their tax return. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Form 1040 Return Delinquency online:

- Press the ‘Get Form’ button to access the Form 1040 Return Delinquency. Open the document in your preferred editing program.

- Begin by entering your contact information. Fill in your Social Security Number, full taxpayer name, address, primary and secondary telephone numbers, city, state, and ZIP code. If your address has changed, make those updates in this section.

- Indicate whether any of the specified circumstances apply to you. If you have already filed a tax return, mark that box and provide details including the name(s) on the return, the forms filed, tax return year(s), and tax return date(s).

- If applicable, indicate if the person addressed on this notice has deceased. Provide the date of death and any necessary details related to Form 1041, if you filed one instead of Form 1040.

- If you believe you are not required to file a tax return for the specified year, explain your reasoning clearly. Include your filing status by selecting one from the options provided.

- Indicate any additional circumstances that may apply to you or your spouse, such as age, citizenship status, blindness, or dependency status.

- If you have a refund credit from a prior year, specify how you wish to apply it — either to another tax return or as a refund check. Include all required details such as social security number and tax period ending.

- Finally, sign and date the form to declare that all information provided is accurate. Review the form for any errors, then save your changes, download, print, or share the completed form as necessary.

Complete your Form 1040 Return Delinquency online today for a smoother filing experience.

IRS Policy Statement 5-133, Delinquent Returns—Enforcement of Filing Requirements, provides a general rule that taxpayers must file six years of back tax returns to be in good standing with the IRS. The policy also states that IRS management would have to approve any deviation from that rule.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.