Loading

Get Adequate Documentation Must Be Submitted To Substantiate Reimbursable Business Expense In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the adequate documentation must be submitted to substantiate reimbursable business expense in online

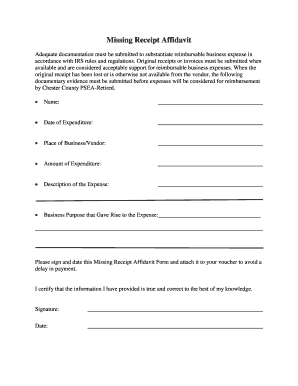

Submitting the adequate documentation for reimbursable business expenses is essential for ensuring your claims are processed efficiently. This guide will help you understand the form and how to complete it accurately in an online format.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field. Make sure to use your full legal name as it appears on your identification.

- Next, input the date of the expenditure in the appropriate section. Use the format MM/DD/YYYY for clarity.

- Provide the place of business or vendor where the expense occurred. This should include the full name of the entity and any relevant location details.

- Enter the amount of the expenditure in the specified field. Ensure that this figure is accurate and corresponds with what you are claiming.

- In the description of the expense section, give a brief but precise overview of the nature of the expense. This helps to substantiate your claim.

- Detail the business purpose that led to the expense. Clearly explain how the expense is related to your business activities.

- Finally, provide your signature and date at the bottom of the form. This indicates that you certify the information provided is true and correct.

- Once completed, review all entries for accuracy. You can then save changes, download the form, print it, or share it as needed.

Accurate documentation is crucial for reimbursement. Complete your forms online today to streamline the process.

The taxpayer can satisfy the stringent substantiation rules – that is, the taxpayer has written evidence of the expense incurred (if required). A taxpayer must actually incur an expense before it is allowed as a deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.