Get Ca Uben 142 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA UBEN 142 online

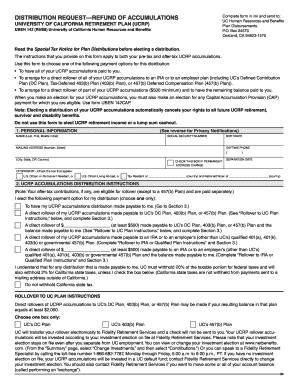

Filling out the CA UBEN 142 form is an important step for individuals seeking distribution from the University of California Retirement Plan. This guide provides detailed instructions for completing the form online, ensuring clarity and ease of understanding for all users.

Follow the steps to successfully complete the CA UBEN 142 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the personal information section, enter your name as it appears on your identification, including your last name, first name, and middle initial. Provide your Social Security number and birthdate. Include your mailing address and daytime phone number, and check the box if your address has changed permanently.

- Indicate your citizenship status by checking the appropriate box that applies to you, whether you are a U.S. citizen, living abroad, or a tax resident of another country.

- In the UCRP accumulations distribution instructions section, select one payment option for your distribution. Choose whether you want your UCRP accumulations paid directly to you, rolled over to an employer plan, or a combination of both. Make sure to specify the rollover amounts as required.

- If applicable, complete the rollover sections based on your choice. For direct rollovers to UC plans or IRAs, provide the necessary certification details and select the appropriate boxes.

- In the required signature section, review your information to ensure accuracy. Certify the truthfulness of your request by signing and dating the form.

- Once you have filled out all sections correctly, save your changes. You can download or print the completed form for your records. Finally, share or submit the form to the designated address provided for processing.

Complete the CA UBEN 142 form online today to manage your distribution effectively.

The 1976 tier refers to a specific set of retirement benefits for California public employees that affects social security calculations. This tier provides distinct retirement options that are important for understanding your benefits under CA UBEN 142. By knowing these details, you can make informed decisions regarding your financial future. Our resources provide deeper insights about the 1976 tier and its implications on social security.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.