Loading

Get Or Consult Your Tax Advisor If You Need Additional Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Or Consult Your Tax Advisor If You Need Additional Information online

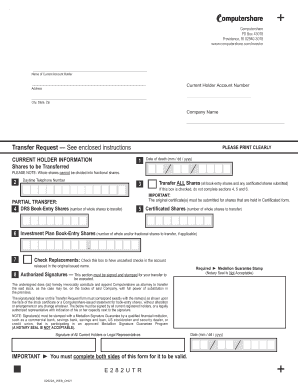

Filling out the 'Or Consult Your Tax Advisor If You Need Additional Information' form can seem complex, but with clear guidance, you can complete it confidently. This document offers a structured approach to help you navigate through each section, ensuring you meet all necessary requirements.

Follow the steps to accurately complete the tax advisor consultation form online.

- Press the ‘Get Form’ button to acquire the form, opening it for further action.

- Carefully read the instructions provided with the form. It's crucial to understand each required field to avoid errors that could delay your process.

- Begin filling out the form by entering your personal details in the designated fields. Ensure that the information is accurate, including your name and contact information.

- Fill in any specific details related to the purpose of the form. This may involve clarifying the tax implications linked to your inquiry.

- If required, include any additional documentation that supports your request. Check for any attachment fields specified in the form.

- Review all entered information thoroughly. Verification is essential to ensure that there are no mistakes that could require resubmission.

- Once everything is confirmed as complete, proceed to save your changes. You may want to download, print, or share the form with relevant parties as needed.

Take the next step—complete your form online for efficient processing.

The most common reason for the IRS to review a tax return is something called the Discriminant Function System (or DIF) score. The IRS uses a computerized scoring model that evaluates your return and gives it a score based on the likelihood that it will need to be changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.