Loading

Get Suta Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Suta Form online

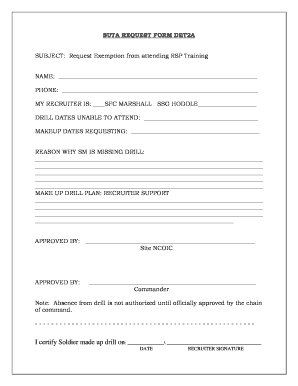

The Suta Form is essential for requesting an exemption from attending RSP training. This guide will walk you through each section of the form, ensuring you understand how to complete it accurately and efficiently.

Follow the steps to fill out the Suta Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your name in the designated field. This is required information necessary for your request.

- Input your phone number in the corresponding field. Ensure that the number is accurate for any follow-up communications.

- In the section labeled 'My recruiter is', specify the name of your recruiter. Use the exact titles as indicated, such as SFC Marshall or SSG Hoddle.

- List the drill dates you are unable to attend. Be precise with dates to facilitate the approval process.

- Next, indicate the makeup dates you are requesting. This helps in organizing your training schedule effectively.

- Provide a clear and concise reason for the missing drill in the designated area. This explanation should be specific to your circumstances.

- Outline your makeup drill plan under the section labeled 'Makeup drill plan: recruiter support'. This should include how your recruiter plans to assist in your training.

- Once you've completed the sections, ensure to get approval from the site NCOIC in the 'Approved by' field.

- Finally, obtain approval from the commander in their dedicated section. This step is critical for your absence to be officially recognized.

- After completing all sections, save your changes. You may also download, print, or share the form as needed.

Ready to complete your Suta Form? Start filling it out online today!

SUTA refers to the taxes paid at the state level, but there is also a federal equivalent paid at the federal level, called the Federal Unemployment Tax Act, or FUTA. FUTA taxes go into a fund that covers the federal government's oversight of the states' individual unemployment insurance programs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.