Loading

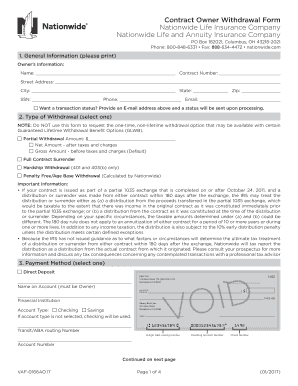

Get Contract Owner Withdrawal Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Contract Owner Withdrawal Form online

This guide provides clear and concise instructions on filling out the Contract Owner Withdrawal Form online. Each section of the form is broken down to ensure that users can complete the form accurately and effectively, regardless of their prior experience with legal documents.

Follow the steps to complete the form accurately

- Click 'Get Form' button to access the Contract Owner Withdrawal Form and open it for editing.

- Provide your personal information in the General Information section. This includes your name, contract number, street address, city, state, zip code, social security number, phone number, and email address. Ensure all information is accurate, as this will be used for processing.

- In the Type of Withdrawal section, choose one of the provided options. Make sure to read the notes carefully, as some choices may have additional requirements or limitations.

- Select your preferred Payment Method. Indicate whether you would like funds to be deposited directly into your account or if you prefer to receive a check by mail. Follow the instructions provided for account verification, including attaching necessary documents such as a voided check for checking accounts.

- Complete the Tax Withholding Elections section. If you prefer not to have taxes withheld from your withdrawal, select that option. If you choose to have federal or state taxes withheld, specify the percentage and the state of residence.

- Review the Disclosure and Certification section. By certifying this section, you confirm that the information you provided is true and accept the potential tax implications of your withdrawal.

- Read and acknowledge the information in the Acknowledgment section regarding potential charges associated with your withdrawal and initial accordingly.

- Fill out the Taxpayer ID Certification, ensuring that your taxpayer identification number is accurate and that you are aware of any IRS backup withholding situations.

- Finally, sign and date the form in the Signature(s) section, including the joint owner's signature if applicable. Ensure all required fields are completed to avoid delays in processing.

- Once you have finished filling out the form, save changes, and proceed to download, print, or share the completed form as needed.

Start filling out your Contract Owner Withdrawal Form online today for a smooth and organized process.

You have the option to withdraw the income as one lump sum payment or split it up into regular payments. 2. You can annuitize many, but not all, income benefits to create a lifetime stream of income. To learn more, please contact us at 1-800-638-7732.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.