Loading

Get Form Crs-e - Crs Entity Self-certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

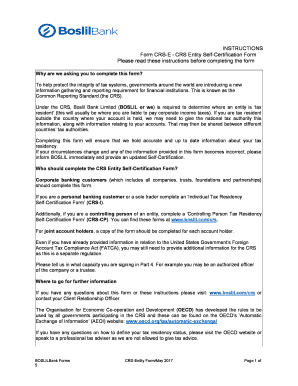

How to fill out the Form CRS-E - CRS Entity Self-Certification Form online

Filling out Form CRS-E is a crucial step for corporate banking customers to declare their tax residency accurately. This guide provides clear, step-by-step instructions to help users complete the form successfully online.

Follow the steps to complete the Form CRS-E online.

- Press the ‘Get Form’ button to access the CRS Entity Self-Certification Form and open it for editing.

- Part 1 – Identification of Account Holder (Entity): Fill in the legal name of the entity, the country or jurisdiction of incorporation or formation, the residence address, and other required details in block capitals. Be specific with the information and avoid P.O. Box addresses.

- Part 2 – Entity Type: Select the appropriate status of the account holder by ticking one of the box options provided (Financial Institution, Active NFE, Passive NFE, etc.). If applicable, provide the FATCA GIIN number and details about Controlling Persons.

- Part 3 – Country(ies)/Jurisdiction(s) of Residence for Tax Purposes: Complete the table indicating all countries where the account holder is a tax resident and include the corresponding Taxpayer Identification Numbers (TINs). If a TIN is unavailable, indicate the reason as instructed.

- Part 4 – Declarations and Signature: Review the declarations carefully. Ensure you are authorized to sign for the account holder. Include your signature, printed name, date, and note the capacity in which you are signing. Attach necessary documents if required.

- Once all sections are completed, save your changes, and then you can download, print, or share the completed form as needed.

Complete your Form CRS-E online today to ensure compliance and accurate tax residency declaration.

The Common Reporting Standard (CRS) is an internationally-agreed standard introduced by the Organisation for Economic Co-operation and Development (OECD) for the automatic exchange of financial information between participating countries / jurisdictions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.