Loading

Get Garnishee Answer To Continuing Garnishment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GARNISHEE ANSWER TO CONTINUING GARNISHMENT online

Filling out the Garnishee Answer to Continuing Garnishment can be a straightforward process with the right guidance. This guide will walk you through each section of the form to ensure that you provide all necessary information accurately and clearly.

Follow the steps to complete your form effectively.

- Press the ‘Get Form’ button to access the Garnishee Answer to Continuing Garnishment document and open it in your preferred editor.

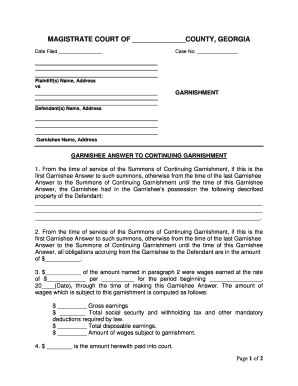

- Begin filling out the header of the form. Input the date filed and the case number relevant to your garnishment case.

- Enter the names and addresses of both the plaintiff and defendant in the designated spaces.

- Specify the name and address of the garnishee (the individual or entity holding the funds or property subject to garnishment).

- In Section 1, provide details about any property in the garnishee's possession that belongs to the defendant, ensuring to describe it accurately.

- Complete Section 2 by detailing all obligations owed from the garnishee to the defendant. Fill in the total amount that is due.

- For Section 3, break down the wages accrued. List the gross earnings, deductions, and the total disposable earnings to determine the amount subject to garnishment.

- In Section 4, indicate the amount being submitted to the court. Ensure this matches the information provided in previous sections.

- Use Sections 5 through 7 to check the appropriate boxes regarding the defendant's employment status and whether this is the final garnishee answer to be filed.

- In Section 8, you can add any additional comments or statements that may be relevant to the case.

- Finally, have the garnishee, their attorney, or an officer of the garnishee sign the document, ensuring all details are correct before submission.

- After completing the form, you can save your changes, download and print the document, or share it with relevant parties as needed.

Complete your documents online today to ensure compliance and accuracy.

Related links form

There are two types of garnishment: Continuing garnishment - The employer will deduct from the defendant's wages for approximately 179 days (or six months) provided the defendant makes wages which are subject to garnishment. garnishment deductions are based on the employee's net pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.