Loading

Get Verification Of Employment And Wages

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Employment And Wages online

Filling out the Verification Of Employment And Wages form online is an important step in ensuring accurate information is submitted. This guide will help you navigate through each section of the form, making the process as straightforward as possible.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to access the verification form and open it in your preferred editor.

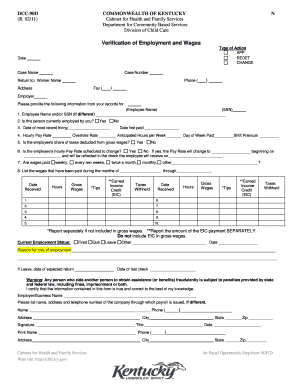

- Begin by entering the date in the designated field. Next, fill in the case name and case number to provide context for the verification.

- Under the 'Worker Name' section, input the name of the individual who will receive the form. Include their phone number and address if required.

- In the employer section, provide the employee’s name and Social Security Number (SSN) if different from the name provided.

- Indicate whether the employee is currently employed by selecting 'Yes' or 'No'. This will guide the rest of the information required.

- Fill in the employee’s hourly pay rate, overtime rate, anticipated hours per week, day of the week they are paid, and any shift premium.

- Clarify if the employee's share of taxes is deducted from gross wages by selecting 'Yes' or 'No'.

- If applicable, indicate whether the employee’s hourly pay rate is scheduled to change. Detail the new pay rate and effective date if 'Yes' was selected.

- Specify how frequently wages are paid—whether weekly, every two weeks, twice a month, monthly, or other.

- List the wages paid during the specified months, including dates received, hours worked, gross wages, tips, Earned Income Credit, and taxes withheld.

- Provide the employee's current employment status and reason for any loss of employment, if applicable. Include the date of last check if relevant.

- Certify the form by filling in the employer or business name, including the contact details of the payroll issuing company if different.

- Finally, add a signature, title, and date to certify that the information is accurate to the best of your knowledge. Once completed, save changes, download, print, or share the form as needed.

Start the process by completing the Verification Of Employment And Wages form online today.

Those requesting employment or salary verification may access THE WORK NUMBER® online at https://.theworknumber.com/verifiers/ using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.