Loading

Get 10a100(p) (07-17)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 10A100(P) (07-17) online

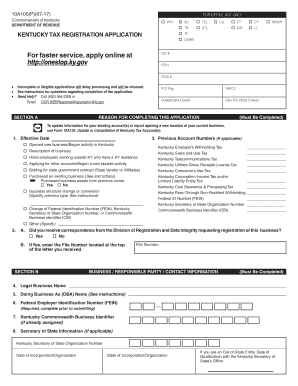

The Kentucky Tax Registration Application (10A100(P) (07-17)) is an essential form for anyone starting or updating a business in Kentucky. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete the 10A100(P) (07-17) online application.

- Press the ‘Get Form’ button to access the form and open it in a suitable editor.

- In Section A, enter the effective date for your application and choose the appropriate reason for completing the form by checking one of the provided boxes.

- In Section B, input your legal business name and the doing business as (DBA) name if applicable. Don’t forget your Federal Employer Identification Number (FEIN) in this section.

- Fill in your primary business location, including the complete street address, city, state, and ZIP code. Make sure to not use a P.O. Box.

- Indicate your business operations and select the accounting period that applies, whether it’s a calendar year, fiscal year, or 52/53 week calendar year.

- Select the business structure that best describes your organization in Section 13, ensuring to provide additional details if 'Other' is selected.

- Complete the ownership disclosure section in Section 15-16 by providing the required information for responsible parties, including names and Social Security numbers.

- In Section C, describe your business’s operations and provide a list of products sold in Kentucky.

- Answer all required questions to identify your business's tax account needs by checking 'Yes' or 'No' as applicable, especially in relation to hiring employees or making sales.

- After completing all sections, review the form thoroughly to ensure all information is accurate and complete, then save your changes.

- Finally, download, print, or share the form according to your needs, or file it directly as instructed.

Start filling out your 10A100(P) (07-17) form online today for a smooth registration process!

To register and file online, please visit wraps.ky.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.