Loading

Get 2017 Form Or-706-disc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2017 Form OR-706-DISC online

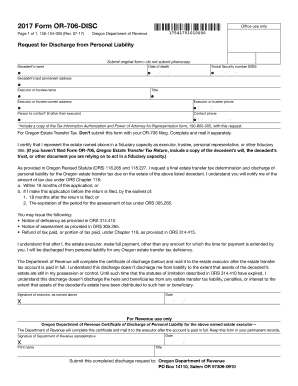

Filling out the 2017 Form OR-706-DISC is an essential step for those seeking discharge from personal liability associated with Oregon estate transfer tax. This guide offers clear instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the discharge request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent’s name clearly in the designated field. Ensure that the name matches official documents to avoid any discrepancies.

- Next, input the date of death of the decedent. This date is crucial for validating the request associated with the estate.

- Provide the decedent’s last permanent address. This should be the address where the decedent resided before passing.

- Fill in the executor or trustee name, along with their title, in the respective fields.

- Input the current address of the executor or trustee accurately to ensure proper communication regarding the estate.

- Enter the social security number of the executor or trustee in the specified format to maintain confidentiality and compliance.

- Include a contact phone number for the executor or trustee, ensuring it is current for any follow-up from the Department of Revenue.

- If there is a person to contact other than the executor, provide their name and phone number here.

- Make sure to attach a copy of the Tax Information Authorization and Power of Attorney for Representation form, 150-800-005, if applicable.

- Certify your representation of the estate by signing in the designated area, and include the date as well.

- Review all input data for accuracy and completeness before finalizing the filing.

- Once you have confirmed the information is correct, you can save the changes made to the form, and choose to download, print, or share the completed form as necessary.

Complete your 2017 Form OR-706-DISC online today to ensure timely processing of your discharge request.

2022 Form OR-706. Oregon Estate Transfer Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.