Loading

Get Internet (7-17)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INTERNET (7-17) online

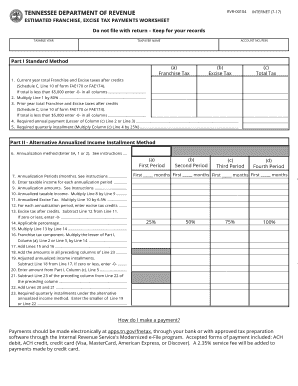

Filling out the INTERNET (7-17) form is crucial for making estimated franchise and excise tax payments in Tennessee. This guide provides detailed, step-by-step instructions to help users navigate the online process effectively.

Follow the steps to fill out the INTERNET (7-17) form accurately.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering the taxable year and your account number or federal employer identification number (FEIN) in the designated fields.

- Provide the taxpayer name in the corresponding field to ensure accurate identification.

- Shift to Part II: Alternative Annualized Income Installment Method. In Line 6, indicate the chosen annualization method by entering 'SA', '1', or '2'.

- Enter the annualization periods (months) for each quarter in Line 7, corresponding to the method selected.

- Provide your taxable income for each annualization period on Line 8, ensuring accurate data is entered.

- For Line 9, input the annualization amounts associated with your selection in Line 7.

- Multiply the taxable income by the annualization amounts in Line 10 to determine the annualized taxable income.

- Compute the annualized excise tax in Line 11 by multiplying Line 10 by 6.5%. Fill in this amount.

- In Line 12, input any excise tax credits applicable for each annualization period.

- Subtract Line 12 from Line 11 in Line 13 to get the excise tax after credits. If the result is zero or less, enter -0-.

- For Line 14, specify the applicable percentage.

- Calculate the franchise tax component in Line 16 by utilizing the lesser of Part I, Column (a), Line 2 or Line 3 multiplied by Line 14.

- Add Lines 15 and 16 together in Line 17 to get your total estimate.

- From Lines 18, populate the totals as necessary based on previous calculations.

- Complete Line 23 with the required quarterly installments as calculated under the method chosen.

- Finally, save your changes, download the form, and print or share it as needed.

Complete your INTERNET (7-17) form online today for an efficient tax payment process.

Online banking is generally defined as having the following characteristics: Financial transactions are conducted over the internet through a bank's secure website. The bank may have physical branch locations or it may exist only online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.