Loading

Get Declaration Of Tax Residence For Individuals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Of Tax Residence For Individuals online

This guide provides a clear, step-by-step approach to completing the Declaration Of Tax Residence For Individuals form online. By following these instructions, you will ensure that your declaration is accurate and complete, helping you to comply with Canadian tax requirements.

Follow the steps to complete the declaration online.

- Click ‘Get Form’ button to obtain the Declaration Of Tax Residence For Individuals form and open it in your preferred online editor.

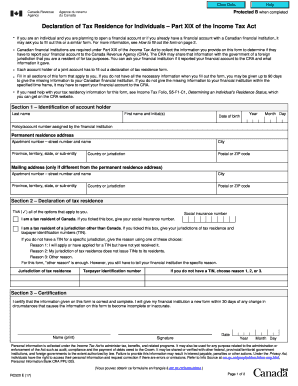

- In Section 1, provide your identification details. Fill in your last name, first name, date of birth (year, month, day), and the policy/account number assigned by your financial institution. Additionally, include your permanent residence address and, if applicable, your mailing address.

- Proceed to Section 2, where you will declare your tax residence status. Tick all applicable options, including whether you are a tax resident of Canada or any other jurisdiction. Provide your social insurance number or taxpayer identification number (TIN) as required. If you do not have a TIN, select the appropriate reason from the options provided.

- In Section 3, certify that the information provided is correct and complete. Print your name, then sign and date the form, ensuring you do this before submitting the form to your Canadian financial institution.

Complete the Declaration Of Tax Residence For Individuals form online to ensure compliance with tax regulations.

Do I still need to file a U.S. tax return? Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.