Loading

Get Form 567

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 567 online

This guide provides clear and comprehensive instructions for completing the Form 567 online. By following these steps, users can easily navigate each section and ensure accurate submission of their filings.

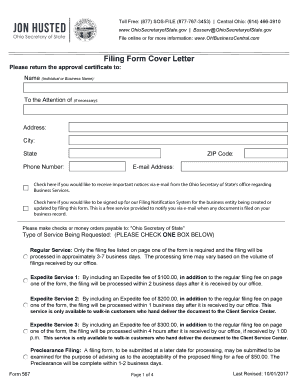

Follow the steps to successfully complete Form 567 online.

- Press the ‘Get Form’ button to access the Form 567, opening it in your preferred editor.

- Enter the name and address details, including the name of the individual or business, city, state, and ZIP code, as well as their phone number and email address.

- Check the boxes if you wish to receive important notices or sign up for the Filing Notification System regarding the business entity.

- Select the type of service you are requesting by checking one of the boxes for Regular, Expedite Service 1, Expedite Service 2, Expedite Service 3, or Preclearance Filing.

- Complete the Credit Card Authorization Form if paying by credit card, or prepare to attach a check or money order made payable to 'Ohio Secretary of State'.

- Fill out the appropriate section based on the type of filing: either Statement of Denial, Statement of Dissociation, or Statement of Dissolution, ensuring you check the correct box.

- Provide the name of the partnership, registration number, and any additional details required for the statement being filed.

- Sign the form in the signature box, ensuring it is signed by an authorized representative and their name is printed as required.

- Review all entries for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Start filling out your Form 567 online today for a seamless filing experience.

Related links form

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.