Loading

Get Company Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Company Property online

This guide provides step-by-step instructions for filling out the Company Property form online. It is designed to help users understand each section and field clearly and comprehensively.

Follow the steps to complete the Company Property form effectively.

- Click the ‘Get Form’ button to access the Company Property form and open it in your preferred editor.

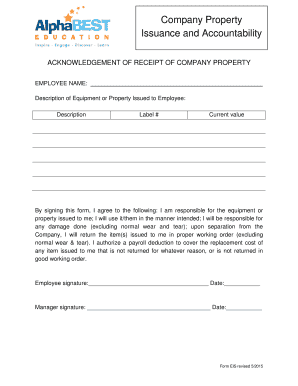

- Begin by entering the employee's name in the designated space. This identifies who is receiving the company property.

- In the 'Description of Equipment or Property Issued to Employee' section, enter a detailed description of the items being issued. Include specifics like the type and model of the equipment.

- Next, fill in the 'Label #' field, which serves as a unique identifier for each piece of equipment or property issued.

- Then, provide the 'Current value' of the items. This is important for accountability and tracking purposes.

- Read through the acknowledgment of receipt and the responsibilities outlined. This section clarifies the expectations regarding the care and return of the issued property.

- Both the employee and manager must sign and date the form at the end. Ensure that each signature is clear and the dates are accurate.

- After completing the form, you can save changes, download, print, or share the completed document as necessary.

Complete your documents online today to ensure efficient management and accountability!

Employers can choose to take legal action. Not being able to recoup the cost of unreturned property via payroll deduction does not mean all is lost, as employers have the option of filing a lawsuit against an employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.