Loading

Get M 5008 R Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M 5008 R Instructions online

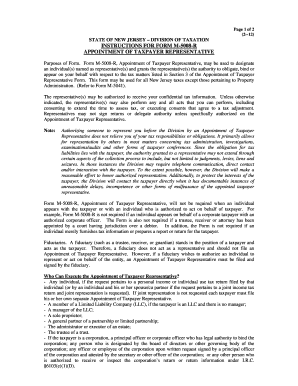

Filling out the M 5008 R Instructions is a crucial step for designating a taxpayer representative for New Jersey taxes. This guide provides clear, step-by-step instructions to help you navigate the online completion of this important document.

Follow the steps to successfully complete the M 5008 R Instructions.

- Click the ‘Get Form’ button to access the M 5008 R Instructions online.

- Begin by entering your personal information in Section 1, ensuring to include your name, address, and identification number.

- In Section 2, provide the details of the representative you are appointing, including their name, address, and identification information.

- Section 3 outlines the specific tax matters for which the representative is authorized. Select the appropriate tax types and periods.

- Review the terms of authorization in Section 4, confirming that your representative can act on your behalf as stated.

- In Section 5, if applicable, provide details regarding any prior appointments that are being revoked or retained.

- Sign and date the form in Section 6, ensuring compliance by including the necessary identification or evidence of authority.

- After completing all sections, you can save changes, download, print, or share the completed M 5008 R Instructions online.

Complete your M 5008 R Instructions online today to ensure your taxpayer representation is officially designated.

If you terminate covered employment before retire- ment, you may withdraw all your contributions less any outstanding loan or other obligations (plus a small amount of interest for PERS or TPAF members with at least three years of service).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.