Loading

Get Tax At Source Card

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax At Source Card online

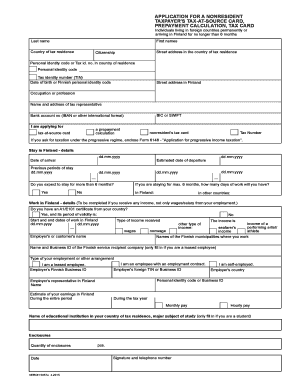

The Tax At Source Card is an essential document for individuals residing outside Finland who need to report their earnings and taxes. Completing this form accurately online can streamline your tax obligations and ensure compliance with local regulations.

Follow the steps to fill out your Tax At Source Card online.

- Click ‘Get Form’ button to obtain the Tax At Source Card and access the digital version of the document.

- Enter your last name and first names in the appropriate fields to identify yourself.

- Indicate your country of tax residence and provide your street address in that country.

- Fill in your citizenship, personal identity code, or Tax ID number from your country of residence.

- Input your date of birth or Finnish personal identity code.

- Provide your street address in Finland for any correspondence related to your tax matters.

- Specify your occupation or profession, and fill out the name and address of your tax representative if applicable.

- Enter your bank account number in IBAN or other international format for any tax-related transactions.

- Select the option you are applying for: prepayment calculation, tax-at-source card, or nonresident's tax card.

- If applicable, enclose Form 6148 for progressive income taxation.

- Fill in your date of arrival in Finland and any previous periods of stay with respective dates.

- Indicate how many days you will work if your stay is for a maximum of six months and whether you expect to stay longer.

- If you are working in Finland, provide details about your income including type, your employer's name, and any other income types.

- If applicable, provide details about your educational institution and your planned earnings during your time in Finland.

- Count the quantity of enclosures you are submitting with the form.

- Sign the form and provide your contact number for any potential follow-up.

- Once you have filled out all required fields, save your changes, download a copy for your records, and print the form if necessary.

Complete your Tax At Source Card online to ensure your tax affairs are in order.

A non-resident individual (e.g. occasionally working in Finland) is taxed on Finnish-source income only. Unless lower rates are provided in a tax treaty, tax rates are 35% on employment income and 30% on dividends, interest (however, interest income is normally not taxable for a non-resident) and royalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.