Get Canada T1213 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1213 online

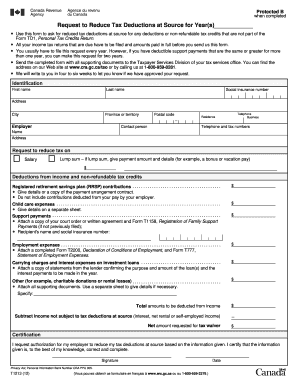

This guide will help you navigate the process of filling out the Canada T1213 form online. Whether you are seeking a reduction in tax deductions at source for the current year or the next, following these steps will ensure you complete the form accurately and efficiently.

Follow the steps to complete the Canada T1213 form online.

- Press the ‘Get Form’ button to obtain the Canada T1213 form and open it in your preferred online editor.

- Fill in your identification details in the designated fields: first name, last name, social insurance number, address, province or territory, city, postal code, and telephone numbers. Ensure all information is correct and up to date.

- In the request section, specify the type of income for which you are requesting to reduce tax deductions at source. Choose between salary or lump sum and provide the payment amount and details, such as bonus or vacation pay if applicable.

- Complete the deductions section by listing all applicable non-refundable tax credits. Include contributions to registered retirement savings plans (RRSPs), child care expenses, support payments, employment expenses, carrying charges and interest expenses on investment loans, or any other deductions. Attach any necessary supporting documents as specified for each category.

- Calculate the total amounts to be deducted from your income. Subtract any income that is not subject to tax deductions at source, such as interest or net rental income, to arrive at the net amount requested for a tax waiver.

- In the certification section, confirm the accuracy of the information provided by signing and dating the form. Your signature indicates that you request authorization for your employer to reduce tax deductions at source based on the provided information.

- Once you have filled out the form and attached all supporting documents, save your changes, and download or print the form for submission. Ensure you send it to the Taxpayer Services Division of your tax services office.

Start filling out the Canada T1213 form online today to streamline your tax deductions.

Get form

The T1213 form is used by individuals who want to request a reduction in tax withheld at the source due to tax deductions or credits they will receive. This form is particularly helpful for those applying for the disability tax credit or other tax alleviation programs. Using the Canada T1213 provides a clear approach to managing your finances while receiving disability assistance efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.