Loading

Get Instructions For Michigan Form F-65 - State Of Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Michigan Form F-65 - State Of Michigan online

Filling out the Instructions for Michigan Form F-65 online can be a straightforward process if you follow the provided guidelines. This comprehensive guide will walk you through each step to ensure your form is completed accurately and efficiently.

Follow the steps to complete the Instructions For Michigan Form F-65 online.

- Click 'Get Form' button to obtain the form and open it for editing.

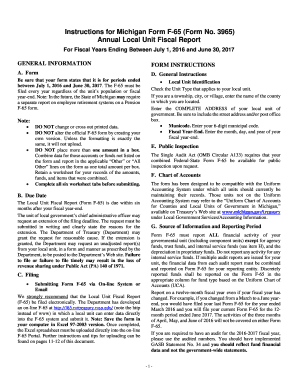

- Ensure that the form correctly indicates it is for periods ending between July 1, 2016, and June 30, 2017. Verify your local unit's identification by checking the unit type, entering the complete address, and the 6-digit municipal code.

- Input the fiscal year-end date by entering the month, day, and year corresponding to the end of your fiscal year.

- Complete all required fields pertaining to financial activities, ensuring all revenues and expenditures are reported according to the forms' guidelines without making any alterations to the format of the document.

- Double-check all entries for accuracy and completeness. Use a worksheet to retain records of combined amounts or funds not listed on the form.

- Submit the completed form electronically. If you have used an Excel spreadsheet, ensure it is in the correct format and upload it directly into the online system.

- Once uploaded, verify that the upload was successful, correct any flagged areas, and ensure you complete the submission process, including any necessary certifications.

- Save any changes you made, then download, print, or share the finalized form as required.

Start filling out the Instructions For Michigan Form F-65 online today to ensure timely and accurate submission.

Form F-65 must report the financial activity of your governmental unit (including component units) except for some elements of agency funds and trust funds. Discretely reported funds shall be reported on the Form F-65 in the appropriate column. Report on a twelve-month fiscal year even if your fiscal year has changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.