Loading

Get Instructions For Probate Without A Will - Co Courts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the INSTRUCTIONS FOR PROBATE WITHOUT A WILL - CO Courts online

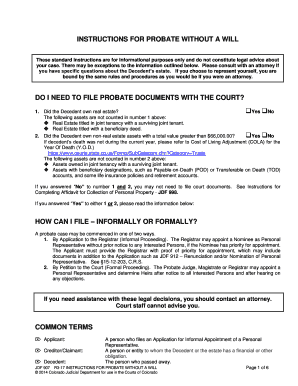

Filing for probate without a will can be daunting for many individuals. This guide aims to provide a clear and supportive overview of the INSTRUCTIONS FOR PROBATE WITHOUT A WILL - CO Courts to help users navigate the online process smoothly.

Follow the steps to complete your probate application effectively.

- To begin, locate and press the ‘Get Form’ button to access the INSTRUCTIONS FOR PROBATE WITHOUT A WILL form. This will allow you to download or view the document for completion.

- Carefully review the initial section that inquires whether the Decedent owned real estate. Choose 'Yes' or 'No' based on the specific assets held by the Decedent, noting any exceptions to ownership outlined in the instructions.

- Proceed to the next section regarding non-real estate assets. Again, select 'Yes' or 'No' based on the total value exceeding $66,000. Guidance is provided regarding the Cost of Living Adjustment for the year of death if applicable.

- Based on your responses in steps 2 and 3, assess whether you need to file probate documents. If your responses indicate that filing is unnecessary, consider reviewing the Instructions for Completing Affidavit for Collection of Personal Property instead.

- Choose the appropriate method to commence probate: Informally by Application to the Registrar or Formally by Petition to the Court. Follow the instructions for either method carefully, ensuring all relevant forms are completed.

- Fill out the Application or Petition form, ensuring the caption is fully completed, which includes the Decedent's name and relevant court information. Make sure to list all living heirs and any alternative names they may have used.

- Once all forms are completed, verify that each document is signed and dated as required before filing with the appropriate court. Ensure you retain copies of all submitted documents for your records.

- Finally, after filing your papers and paying the requisite filing fee, fulfill any additional requirements set by the court upon the appointment of a Personal Representative, as outlined in the instructions.

Get started by filing your probate documents online today.

If you die without a will in Illinois, your estate and all decisions about your estate will go to your closest relatives. Your assets that fall under intestacy laws include property, bank accounts and retirement savings that you own outright in only your name, and are not co-owned with anyone else.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.