Loading

Get Canada Cf2900 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada CF2900 online

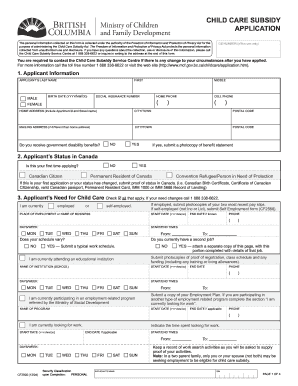

The Canada CF2900 form is essential for applying for child care subsidies. This guide provides a detailed, step-by-step approach to help you complete the form online with ease and confidence.

Follow the steps to accurately complete the online application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the Applicant Information section. Fill in your last name, first name, middle name, birth date, and Social Insurance Number. Ensure that you also provide your home and mailing address as needed.

- In the Applicant’s Status in Canada section, indicate whether you are a Canadian citizen, permanent resident, or refugee. If this is your first application, be prepared to submit proof of your status.

- Next, address the Applicant's Need for Child Care section. Select all relevant options that apply to your employment and education status. If you are currently employed, include details such as your place of employment, work schedule, and any necessary documentation.

- Proceed to the Applicant's Marital Status section. Provide the necessary information if you are married or in a common-law relationship. If your spouse receives disability benefits, include required documentation.

- In the Income Test section, check the circumstances that apply to your situation and list all sources of income. Be sure to submit proof for each source.

- List all children who require child care. Include identification for each child and detail the times and days care is needed.

- Next, provide details about any dependent adults or children living in your household. Attach extra sheets if needed and remember to provide identification for each new individual listed.

- Finally, complete the Declaration section, confirming the accuracy of the information provided. Both the applicant and spouse should sign and date the application.

- Save your completed application. You can download, print, or share it as necessary. Ensure you maintain a copy for your records.

Submit your completed Canada CF2900 application online today for timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can claim a caregiver amount for your parents in Canada under certain conditions. To be eligible, your parents must have a low income and require aid due to a disability or other reasons. The Canada CF2900 will guide you on what is necessary to claim this credit. If you need assistance with the process, uslegalforms offers user-friendly resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.