Loading

Get Form 106sum

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 106sum online

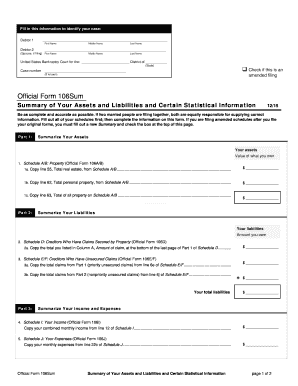

Filling out the Form 106sum is a crucial step in the bankruptcy process, allowing individuals to summarize their assets and liabilities. This guide provides clear instructions for users to effectively complete this form online, ensuring a smooth filing experience.

Follow the steps to complete the Form 106sum accurately and efficiently.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Provide identifying information for the debtor(s). Fill in the first name, middle name, and last name for Debtor 1. If applicable, fill in the spouse's (Debtor 2) first, middle, and last name.

- Indicate the jurisdiction by filling in the district and state of the United States Bankruptcy Court where you are filing your case.

- If you have a case number, enter it in the designated space. If this is an amended filing, check the appropriate box to indicate this.

- In Part 1, summarize your assets. For real estate, copy the total value from Schedule A/B, line 55. Repeat this for personal property from line 62, and total property from line 63.

- In Part 2, summarize your liabilities. For secured claims, copy the total from Schedule D, Column A. In addition, copy priority unsecured claims from Schedule E/F, line 6e, and nonpriority unsecured claims from line 6j.

- In Part 3, summarize your income and expenses by copying the combined monthly income from Schedule I, line 12, and monthly expenses from Schedule J, line 22c.

- In Part 4, answer the questions regarding your bankruptcy filing status. Check ‘yes’ or ‘no’ for the chapter of bankruptcy you are filing under.

- Fill in the type of debt you have, indicating whether your debts are primarily consumer debts. If applicable, provide your current monthly income from the relevant statement.

- Finally, provide details on any special categories of claims from Schedule E/F, ensuring to fill in each applicable amount. After completing the form, save your changes and choose your preferred method to download, print, or share the form.

Start filling out your Form 106sum online today to ensure accurate and timely filing.

What is Schedule AL? Schedule AL enables a taxpayer to disclose assets and the corresponding liabilities in the ITR filed by the taxpayer. The values of the assets and liabilities standing at the end of the year are required to be disclosed in the schedule AL.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.