Loading

Get Health Savings Account (hsa) Employee Contribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account (HSA) EMPLOYEE CONTRIBUTION FORM online

Filling out the Health Savings Account (HSA) EMPLOYEE CONTRIBUTION FORM online can be a straightforward process. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form

- Press the ‘Get Form’ button to obtain the necessary form and open it in the editor.

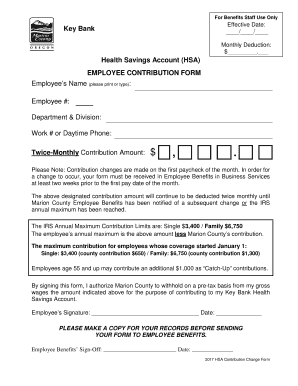

- Enter your name in the 'Employee’s Name' field. Ensure you provide your full name, printed clearly.

- Fill in your Employee number in the designated field, as it is required for identification.

- Complete the 'Department & Division' section by specifying your work department and division.

- Provide your daytime phone number in the 'Work # or Daytime Phone' field to ensure easy communication if needed.

- Indicate your 'Twice-Monthly Contribution Amount' by typing the specific dollar amount you wish to contribute to your HSA.

- Be aware that any contribution changes will take effect on the first paycheck of the month. Your form must be submitted at least two weeks prior to this date.

- Review IRS annual maximum contribution limits for HSA accounts based on your coverage type and age. Ensure your contribution does not exceed these limits.

- Sign and date the form at the bottom to authorize the withholding of the indicated contribution amount for your HSA.

- Make a copy of the completed form for your records before submitting it to Employee Benefits.

- Submit the completed form to Employee Benefits for processing.

Complete your Health Savings Account (HSA) EMPLOYEE CONTRIBUTION FORM online today to ensure your contributions are set accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Health Savings Account (HSA) You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically (based upon your elected delivery preference). These IRS tax forms are also available in the Member Website. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.