Loading

Get Form Uc 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form UC 1 online

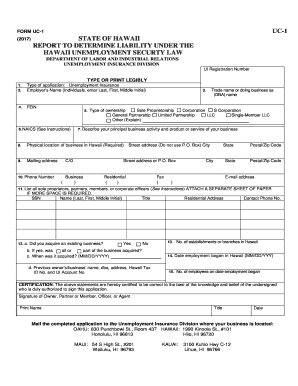

The Form UC 1 is an essential document for individuals and organizations in Hawaii that have employees and need to register for an Unemployment Insurance account. This guide provides clear instructions to assist you in filling out the form online.

Follow the steps to successfully complete the Form UC 1 online.

- Press the ‘Get Form’ button to obtain the form and open it in your browser.

- Complete the application type by selecting 'Unemployment Insurance' and entering your employer's name as it appears on your tax return.

- Provide your Federal Employer Identification Number (FEIN) in the designated field.

- Indicate your trade name or doing business as (DBA) name, if applicable.

- Choose the type of ownership from the given options, marking the relevant box according to your business structure.

- Enter your 6-digit North American Industry Classification System (NAICS) code and describe your principal business activity.

- Clearly state the physical business location in Hawaii and provide a mailing address if different.

- Fill in your primary contact information, including phone numbers and email address.

- List all sole proprietors, partners, members, or corporate officers. If necessary, attach additional sheets.

- Answer questions regarding the acquisition of any existing business and provide details about the previous ownership.

- Indicate the number of establishments or branches in Hawaii, the date employment began, and the number of employees at that time.

- Finalize the application by having a duly authorized individual sign and date the form.

- Save changes, download a copy, and print the completed form for your records.

Start filling out your Form UC 1 online today to ensure compliance and secure your Unemployment Insurance account.

Unemployment Compensation (UC) protects workers who experience job loss by providing temporary income support to people who become unemployed through no fault of their own. UC Benefits are paid, for a limited time, to individuals who are able and available for suitable work and are actively seeking new employment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.