Loading

Get Inheritance Tax Forms - Pa Department Of Revenue - Pa.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inheritance Tax Forms - PA Department Of Revenue - PA.gov online

Filling out the Inheritance Tax Forms can seem daunting, but with the right guidance, the process can be straightforward and efficient. This guide provides step-by-step instructions to help you complete the application's requirements accurately and confidently.

Follow the steps to fill out the Inheritance Tax Forms with ease.

- Click the ‘Get Form’ button to obtain the Inheritance Tax Form and open it in your editor.

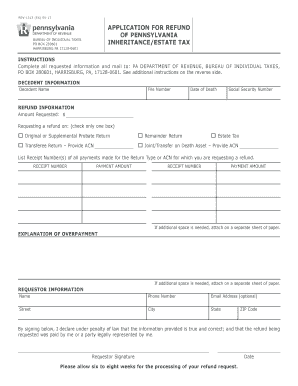

- Begin by entering the decedent information. Fill in the decedent's name, file number, date of death, and social security number in the appropriate fields.

- For the refund information section, enter the amount requested for the refund. Choose only one option to indicate the type of return or ACN you are requesting a refund for: original or supplemental probate return, transferee return (provide ACN), remainder return, estate tax, or joint/transfer on death asset (provide ACN).

- List the receipt numbers of all payments made related to the return type or ACN. For each payment listed, include the corresponding payment amount.

- In the explanation of overpayment section, describe the reason for the overpayment or refund request. If you require more space, please attach additional sheets as necessary.

- Fill in the requestor information, including the name, phone number, email address (optional), street address, city, state, and ZIP code of the person requesting the refund.

- Finally, print the form and sign below your printed name. Note that electronic signatures are not accepted, and ensure to date the form.

- After completing the form, you may save your changes, download it, print a copy, or share it as needed.

Start filling out the Inheritance Tax Forms online to ensure your refund request is submitted promptly.

How to file a return. Complete the inheritance tax return. Download Form REV-1500—Pennsylvania Inheritance Tax Return Resident Decedent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.