Get Form Gst Reg-22 - Taxmantra.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form GST REG-22 - Taxmantra.com online

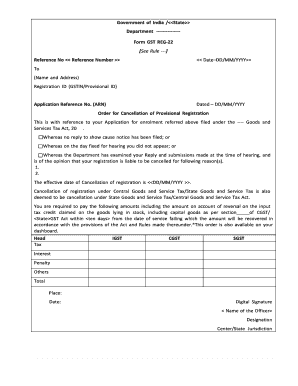

Filling out the Form GST REG-22 is an essential step for individuals seeking to manage their provisional registration under the Goods and Services Tax framework. This guide will walk you through each section of the form, providing clear instructions to ensure a smooth online filing experience.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your document manager.

- Begin by entering your name and address in the designated fields. Make sure all details are accurate to avoid potential issues.

- Input your Registration ID (GSTIN/Provisional ID) correctly, as this is crucial for identifying your application.

- Provide the Application Reference Number (ARN) assigned to your application for tracking purposes.

- Fill in the date of your application submission in the specified format (DD/MM/YYYY).

- Review the sections regarding the order for cancellation of provisional registration. Note any relevant reasons listed.

- Carefully complete the areas detailing the effective date of cancellation and any amounts due, ensuring accuracy in financial figures.

- Conclude by reviewing all information entered, ensuring that it is up to date and correctly formatted.

- After verification, save your changes. You may also choose to download, print, or share the completed form as necessary.

Start filling out your Form GST REG-22 online today.

Late fees for annual GST returns Thus, a total of INR 200 per day is applicable till the date late fees have been paid. The maximum penalty amount cannot be more than 0.25% of the total turnover of the taxpayer for the particular financial year. Late Fees & Interest on GST Returns - Tax2win tax2win.in https://tax2win.in › guide › gst-return-late-fees tax2win.in https://tax2win.in › guide › gst-return-late-fees

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.