Loading

Get Risk Based Pricing Notice With Credit Score Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Risk Based Pricing Notice With Credit Score Information online

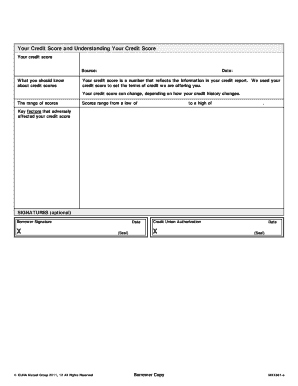

Completing the Risk Based Pricing Notice With Credit Score Information is essential for understanding the terms of credit offered to you based on your credit history. This guide will provide clear, comprehensive steps to help you navigate the process of filling out the form online effectively.

Follow the steps to complete your Risk Based Pricing Notice online

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the name of the entity providing the notice. This typically refers to the lender or financial institution issuing the notice.

- Input your personal information in the ‘Borrower’ field, including your full name.

- Enter your ‘Account Number’ in the designated field to tie the notice to your specific credit account.

- Make sure to add the correct date of issuance for the Risk Based Pricing Notice.

- In the section labeled ‘What is a credit report?’, you can leave the provided definition as is or provide additional explanation if necessary.

- Fill in the terms of credit that were set based on your credit reports in the relevant section.

- Review the section regarding disputing errors in your credit report to ensure accuracy and comprehension.

- Provide information for those who might wish to contact consumer reporting agencies by including their names and relevant contact details.

- Summarize how users can obtain a copy of their credit reports within 60 days, including the relevant agencies' contact information.

- Finish the form by checking for accuracy and completeness, then save your changes. You may choose to download, print, or share the completed form as needed.

Start filling out your Risk Based Pricing Notice online today to ensure you have all the information you need.

A risk-based pricing notice must tell the consumer: that a consumer report includes information about the consumer's credit history and the type of information included in that history. the terms offered were based on information from a consumer report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.