Loading

Get Undertaking To File An Income Tax Return By A Non-resident ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Undertaking To File An Income Tax Return By A Non-Resident online

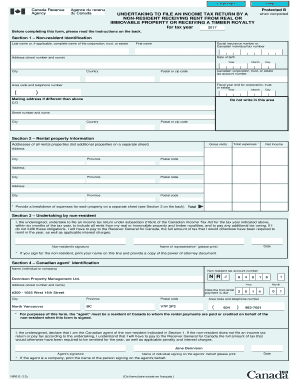

This guide provides clear and detailed instructions for completing the Undertaking To File An Income Tax Return By A Non-Resident form online. It is designed to assist non-residents in ensuring compliance with Canadian tax obligations regarding rental income or timber royalties.

Follow the steps to complete your undertaking form accurately.

- Click ‘Get Form’ button to access the Undertaking To File An Income Tax Return By A Non-Resident form and open it for editing.

- In Section 1, provide your personal or corporate information. Include your last name or the complete name of the corporation, trust, or estate, as well as your social insurance number or Canadian individual tax number, and first name. Additionally, indicate your date of birth and residential address, including country and postal code. If your mailing address differs from your residential address, provide that information as well.

- Moving to Section 2, list all rental properties. Enter the addresses, including street number, city, province, and postal code. For each property, provide gross rents, total expenses, and net income. If you have multiple properties, list additional ones on a separate sheet. Include an itemized estimate of your expenses for each property on another sheet.

- In Section 3, you must sign and date the form. If a representative is signing on your behalf, they need to print their name and attach a copy of the power of attorney document to validate the undertaking.

- In Section 4, the Canadian agent's details must be filled in. This includes their name, address, and non-resident tax account number. Ensure the agent signs and dates the form, acknowledging their responsibility.

- Once all sections are completed and verified for accuracy, you may save the changes made to the form. You can then download, print, or share the completed document as needed.

Complete your undertaking form online to ensure compliance with Canadian tax regulations.

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.