Loading

Get W4 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 2017 online

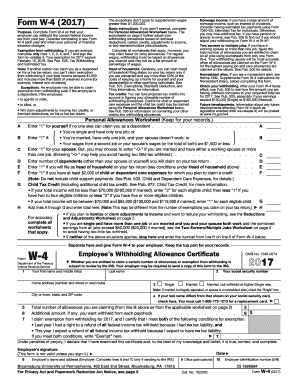

Filling out Form W-4 is an essential step for employees to ensure the correct amount of federal income tax is withheld from their earnings. This guide offers a clear, step-by-step approach to completing the W-4 2017 form online, catering to users with various levels of familiarity with tax documentation.

Follow the steps to complete the W-4 2017 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the indicated fields, including your first name, last name, home address, and social security number.

- Select your filing status by choosing either Single or Married. If you are married but your spouse is a nonresident alien or you are legally separated, indicate that you are Single.

- If your last name differs from that on your social security card, check the box provided. Contact the relevant agency to obtain a replacement card if necessary.

- Enter the total number of allowances you are claiming based on the Personal Allowances Worksheet. Make sure to follow the instructions on the worksheet carefully.

- If you want an additional amount withheld from each paycheck, specify the amount in the field provided.

- If claiming exemption from withholding, make sure to write 'Exempt' and confirm the eligibility conditions are met.

- Sign and date the form to certify the information provided. The form is not valid without your signature.

- Review your completed form for any errors or omissions before submission.

- Finally, save your changes, and you may choose to download, print, or share the form as needed.

Complete the W-4 2017 form online to ensure your withholding is accurate.

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.