Loading

Get Bi Weekly Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bi Weekly Payroll online

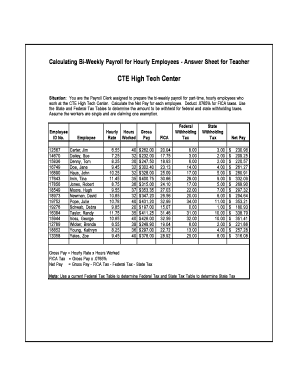

This guide provides clear and comprehensive instructions for filling out the Bi Weekly Payroll form online. Designed for part-time, hourly employees, it ensures accurate calculations and smooth processing.

Follow the steps to accurately complete the Bi Weekly Payroll form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the Employee ID numbers in the designated section for each individual. Ensure each ID matches the corresponding employee name for clarity.

- Next, fill out the employee names next to their respective ID numbers. Use the information provided to maintain accuracy.

- Input the hourly rates for each employee next to their names in the designated field. Refer to the specified hourly rates to avoid discrepancies.

- Record the hours worked for each employee. Ensure that the hours align with the payroll period being processed.

- Calculate the gross pay for each employee using the formula: Gross Pay = Hourly Rate x Hours Worked. Enter this amount in the gross pay section.

- Deduct 7.65% for FICA taxes from the gross pay for each employee. Use the formula: FICA Tax = Gross Pay x .0765% and document the result.

- Determine the federal withholding tax based on the employee's gross pay and refer to the current Federal Tax Table for appropriate deductions. Record this in the federal withholding tax section.

- Calculate the state withholding tax using the corresponding State Tax Table. Input the calculated amount into the state withholding tax field.

- Finally, calculate the net pay for each employee using the formula: Net Pay = Gross Pay - FICA Tax - Federal Tax - State Tax. Ensure that each calculation is accurate and reflected in the net pay section.

- Once all fields are filled out, review the form for any errors or omissions. After verification, save your changes, download the completed form, or print it for record-keeping.

Take the time to complete your bi-weekly payroll online accurately and efficiently.

Biweekly pay describes paychecks that arrive every two weeks, resulting in 26 paychecks per year. Biweekly pay differs from semimonthly pay, which is issued twice per month and 24 times per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.