Loading

Get Section 125 (pop Plan) Application - Oca Benefit Services

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 125 (POP Plan) Application - OCA Benefit Services online

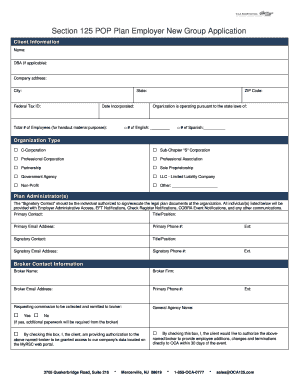

Filling out the Section 125 (POP Plan) Application is an essential step for organizations wishing to provide employees with pre-tax benefits. This guide offers a step-by-step process to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the client information, including the organization name, address, phone number, and Federal Tax ID. You will also need to fill in the state and date of incorporation, so ensure you have this information readily available.

- Indicate the type of organization by checking the appropriate box from the options provided. Make sure to choose the classification that accurately represents your entity.

- Provide details for the plan administrator(s). Enter the primary contact's name, title, email address, and phone number. Also, include the signatory contact’s information, ensuring you include their title and contact details.

- Fill out the broker contact information, which includes the broker's name, firm, email address, and phone number. Be sure to check whether you are requesting the commission to be collected and remitted to the broker.

- Specify the plan details by entering the plan effective date and plan name. Indicate the plan duration, selecting either calendar year or specific plan year dates.

- Choose the benefits selected under the Section 125 Plan. Carefully check the boxes for the benefits being elected to ensure accurate records.

- Complete the controlled group information section by responding to whether any parent, subsidiary, or brother/sister relationships exist with other corporations.

- Review and indicate the eligibility requirements for employees participating in the plan. Specify any exclusions and the service period needed for eligibility.

- Outline the deduction and payment limitations, indicating the payment schedule for employees and how deductions will be processed.

- Document the employee termination requirements for participants in the flexible spending account (FSA) regarding claim submission post-termination.

- Finally, ensure that the form is signed appropriately by the employer, including the signature of a company officer, along with their printed name, title, and date. Review the completed application for accuracy before submission.

- Once all steps are completed, save your changes and choose to download, print, or share the form as necessary.

Complete your Section 125 (POP Plan) Application online today to streamline your employee benefits process.

A Section 125 plan is part of the IRS code that enables and allows employees to take taxable benefits, such as a cash salary, and convert them into nontaxable benefits. These benefits can be deducted from an employee's paycheck before taxes are paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.