Loading

Get Application For Tax Deduction Card

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Tax Deduction Card online

Filling out the Application For Tax Deduction Card online can be a straightforward process when you follow the right steps. This guide provides detailed instructions on how to complete the form accurately and efficiently.

Follow the steps to successfully complete your application.

- Click 'Get Form' button to obtain the form and open it in the editor.

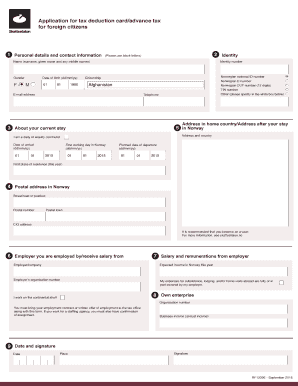

- Begin by entering your personal details and contact information. Use block letters for clarity. Fill in your full name, citizenship, email address, and telephone number including the country code.

- Provide your identity number. Indicate the type of identity number you possess by ticking the appropriate box, such as Norwegian national ID number, D number, DUF number, or TIN number.

- In the section about your current stay in Norway, fill out the fields with your expected dates of arrival, first working day, and planned date of departure using the format dd/mm/yy.

- Complete the postal address in Norway. Ensure to include the street, postal number, and town. If applicable, provide a c/o address of the person you are staying with.

- Detail your employer information by stating the name and organization number of your employer. Check the box if you work on the Norwegian continental shelf.

- Declare your expected income in Norwegian kroner (NOK) from your employer for the year.

- If you run your own enterprise, provide the organization number and expected annual business income.

- Finally, provide the date, place, and your signature to confirm the accuracy of your information before submitting the form.

- After completing all the sections, save your changes, download or print the completed form, and share it if necessary.

Start your application process online today for a seamless experience.

Your employer retrieves your tax deduction card directly from the Tax Administration. You'll receive information about your tax deduction card, a tax deduction notice, which will be sent to the address that's registered for you in the National Registry. You do not have to give anything to your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.