Loading

Get Ir360 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir360 Form online

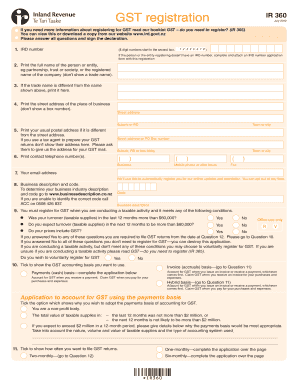

Filling out the Ir360 Form is an essential step for businesses registering for Goods and Services Tax (GST). This guide will walk you through each section, ensuring you complete the form accurately and efficiently.

Follow the steps to complete the Ir360 Form online:

- Click the ‘Get Form’ button to obtain the Ir360 Form and open it in your online editor.

- Enter your IRD number. This is an 8-digit number that must start in the second box. If you do not have an IRD number, you will need to complete and attach an IRD number application form with your registration.

- Print the full name of the person or entity registering, such as a partnership, trust, society, or the registered name of the company. Do not include any trade names.

- If applicable, specify the trade name that differs from the registered name.

- Provide the street address of your place of business without using a box number. Include details such as suburb or rural district, and town or city.

- If your postal address differs from your street address, include it here. Do not use your tax agent's address.

- Print your contact telephone number(s): business, mobile, and fax numbers.

- Enter your email address for registration updates and newsletters, with an option to opt out later.

- Complete the business description and the relevant code, which you can find at www.businessdescription.co.nz.

- Answer the questions about your taxable supplies, indicating whether your turnover in the last or expected next 12 months exceeds $60,000.

- Select your preferred GST accounting basis: payments (cash) basis, invoice (accruals) basis, or hybrid basis, and provide any necessary explanations.

- Choose how often you wish to file GST returns: two-monthly, one-monthly, or six-monthly, and complete the relevant applications if needed.

- Specify the desired start date for your GST registration.

- Indicate whether you will make exempt supplies, are an exporter, or an importer.

- Answer questions about your support for GST compliance, including the use of an accountant or prior experience with GST.

- Print the full name and contact number of the person we should reach out to for any clarifications.

- Choose how you prefer any potential GST refund to be provided: to your bank account or by cheque.

- Sign the declaration confirming that all provided information is true and correct, followed by the date.

- Review all answers to ensure accuracy before sending the completed form to the designated postal address.

Complete your Ir360 Form online today to ensure timely GST registration.

Services performed outside New Zealand are zero-rated. For example, if a NZ singer performs overseas, they will charge GST at 0%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.