Loading

Get Declaration Of Status For Israeli Income Tax Acs (2) - Final.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DECLARATION OF STATUS FOR ISRAELI INCOME TAX ACS (2) - FINAL.doc online

This guide will assist you in completing the DECLARATION OF STATUS FOR ISRAELI INCOME TAX ACS (2) - FINAL.doc form online. Follow these instructions carefully to ensure that you fill out the form correctly and efficiently.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the form and open it in your editor.

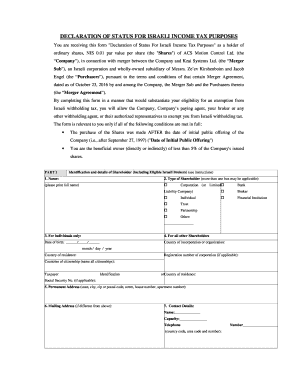

- In Part I, provide your identification details as a shareholder. Fill in your full name and select the type of shareholder by marking the appropriate boxes (corporation, individual, etc.).

- For individuals, enter your date of birth, country of citizenship, and complete your permanent address and mailing address if they differ.

- Provide contact details including name, capacity, and telephone number.

- Indicate how you hold the shares—either directly or through a broker—by marking the appropriate box and provide the broker’s name if applicable.

- Confirm that you are the beneficial owner of less than 5% of the company’s issued shares by selecting 'Yes' or 'No.'

- In Part II, if you are an individual, complete the declarations confirming that you are not a resident of Israel for tax purposes and that you acquired shares post-initial public offering.

- If representing a corporation, partnership, or trust, ensure that you fill out the respective declaration sections accurately according to your entity's status.

- In Part III, banks or financial institutions should confirm their residency and their role in holding shares on behalf of beneficial shareholders.

- In Part IV, certify the accuracy of the information provided by signing and dating the form. Include the number of shares and brokerage firm information if applicable.

- Finally, review the completed form for any errors or missing information before saving your changes. Once finalized, download, print, or share the form as needed.

Start filling out your form online today to ensure you meet all requirements!

I have a form 106, which is the Israeli equivalent of a W-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.