Loading

Get Ybm Gst-invoice-format Ver 2.xlsx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the YBM GST-Invoice-Format Ver 2.xlsx online

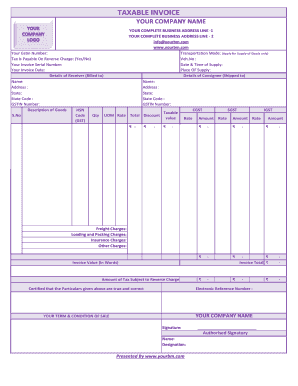

This guide provides a clear and comprehensive overview of how to complete the YBM GST-Invoice-Format Ver 2.xlsx online. Whether you are familiar with digital forms or new to filling invoices, these instructions will assist you in navigating each section effectively.

Follow the steps to complete the YBM GST-Invoice-Format Ver 2.xlsx.

- Press the ‘Get Form’ button to download the YBM GST-Invoice-Format Ver 2.xlsx and open it in your preferred online document editor.

- Begin by entering your company name in the designated field at the top of the form, followed by your complete business address in the appropriate lines below.

- Input your GSTIN number in the specified section. This is critical for tax identification.

- Fill out the Transportation Mode if you are supplying goods, and indicate whether tax is payable on reverse charge by selecting 'Yes' or 'No'.

- Record your invoice serial number and the date and time of supply in their respective fields. This will help in proper documentation.

- Indicate the place of supply and proceed to the Details of Receiver and Consignee sections. Enter the names and addresses as required.

- In the description section for goods, provide the details such as HSN code, quantity, unit of measure, rate, and total amount related to the taxable value.

- Fill out all additional charges such as freight, loading, packing, and insurance in their respective fields.

- At the bottom, enter the invoice value in words, and detail the amount subject to reverse charge where applicable.

- Before finalizing, ensure all fields are accurately filled and validate the particulars to certify that they are true and correct.

- Finally, save your changes. You can download, print, or share the completed invoice as required.

Start completing your YBM GST-Invoice-Format Ver 2.xlsx online today!

How to Create an Invoice in Word from Scratch Step 1: Open a New Blank Document. ... Step 2: Create a Header. ... Step 3: Add Invoice Payment Due Date & Invoice Number. ... Step 4: Enter the Client's Contact Information. ... Step 5: Create an Itemized List of Services and Products. ... Step 6: Include Additional Payment Terms or Notes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.