Loading

Get Inherited Ira Application - Bolton Global Capital

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inherited IRA Application - Bolton Global Capital online

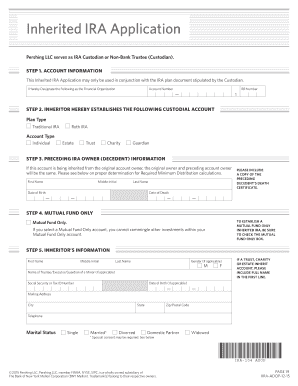

Filling out the Inherited IRA Application is an important step in managing inherited retirement assets. This guide provides a comprehensive, step-by-step approach for completing the application online, ensuring users can navigate the form with confidence.

Follow the steps to complete your Inherited IRA Application.

- Click ‘Get Form’ button to obtain the Inherited IRA Application and open it in your preferred editor.

- Provide your account information. In this section, designate the financial organization managing your inherited IRA and include relevant identifiers such as account number and RR number.

- Enter details about the preceding IRA owner. This includes their first name, middle initial, last name, date of birth, and date of death. Remember to attach a copy of the decedent's death certificate.

- If applicable, check the 'Mutual Fund Only' box to establish a Mutual Fund Only inherited IRA, ensuring no other investments will be combined in this account.

- Input your personal information as the inheritor. Include your first name, middle initial, last name, gender, social security or tax ID number, and mailing address. Indicate your marital status accordingly.

- Fill out the required minimum distribution information if applicable. Choose your relationship to the decedent, provide your date of birth, and state whether you are a spouse or non-spouse.

- Complete the beneficiary designation section, noting names, percentages, and relevant details for primary and contingent beneficiaries. Ensure the total percentages equal 100%.

- If applicable, complete the spousal consent section to ensure your designations are valid, especially if your primary beneficiary is not your spouse.

- Review and acknowledge the certification section, confirming eligibility for the IRA, the truthfulness of the information provided, and your understanding of the requirements. Sign and date the application.

- Once all sections are completed, save your changes. You can then download, print, or share the filled-out form as needed.

Start your Inherited IRA Application process online today!

Generally, a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the IRA owner (this is known as the 10-year rule). There are exceptions for certain eligible designated beneficiaries, defined by the IRS, as someone who is either: The IRA owners' spouse.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.