Get Ncb Wire Transfer Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

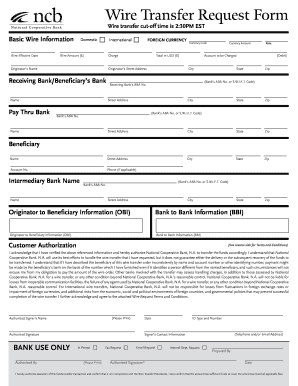

How to fill out the NCB Wire Transfer Request Form online

Completing the NCB Wire Transfer Request Form online is a straightforward process that allows you to conveniently transfer funds. This guide offers step-by-step instructions to help you accurately fill out the form, ensuring your wire transfer is processed efficiently.

Follow the steps to complete your wire transfer request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the basic wire information section. Indicate the wire effective date and select if it is a domestic or international transfer. For foreign currency transfers, specify the currency code and the wire amount in dollars.

- Complete the originator’s information. Provide your name, street address, city, state, and zip code. Ensure that your contact information, including your account number and phone number (if applicable), is accurate.

- Input the details for the receiving bank. This includes the name and the ABA number or S.W.I.F.T. code of the receiving bank. If applicable, provide information for any intermediary bank as well.

- Add any originator to beneficiary or bank to bank information that is required for the transfer, ensuring you follow the specified guidelines for clarity and accuracy.

- Review the customer authorization section. Acknowledge and verify that all provided information is correct. This is crucial as it states your authorization for the bank to process the wire transfer.

- Sign and date the form, including the authorized signer’s name to confirm your agreement with the terms and conditions outlined in the document.

- Once all sections are completed accurately, you can save changes, download the form, and prepare it for submission.

Start filling out your NCB Wire Transfer Request Form online to ensure a smooth transaction process.

To add an international beneficiary in NCB online, log in to your account and navigate to the wire transfer section. Here, you can find the option to add a new beneficiary, where you will need to enter the beneficiary's banking details, including their SWIFT code. After filling out the necessary information, save the changes, and you can use this beneficiary for future transactions via your NCB Wire Transfer Request Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.