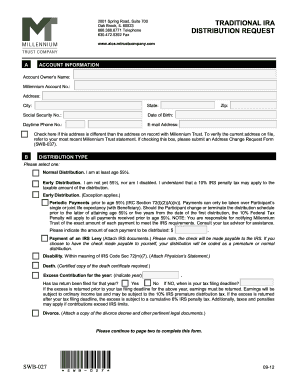

Get Millennium Trust Company Ira Distribution Request 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Millennium Trust Company IRA Distribution Request online

How to fill out and sign Millennium Trust Company IRA Distribution Request online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the benefits of finalizing and submitting legal documents online.

Utilizing our platform, completing the Millennium Trust Company IRA Distribution Request will only take a few minutes.

Send your newly completed Millennium Trust Company IRA Distribution Request electronically as soon as you have finalized it. Your data is securely safeguarded, as we adhere to the latest security protocols. Join the multitude of satisfied clients who are already completing legal templates from the comfort of their homes.

- Locate the document template you wish to use from our collection of legal form samples.

- Click the Get form button to open it and begin editing.

- Fill in the necessary fields (they will be highlighted in yellow).

- The Signature Wizard will assist you in adding your electronic signature after you’ve finished entering your information.

- Add the pertinent date.

- Review the entire form to ensure all information has been completed and no adjustments are necessary.

- Click Done and save the completed template to your device.

How to revise Get Millennium Trust Company IRA Distribution Request 2012: personalize forms online

Streamline your document preparation workflow and tailor it to your specifications in just a few clicks. Complete and validate Get Millennium Trust Company IRA Distribution Request 2012 utilizing a powerful yet user-friendly online editor.

Handling paperwork is consistently cumbersome, particularly when you deal with it sporadically. It requires you to diligently adhere to all regulations and fill in all sections with full and accurate information. Nonetheless, it frequently occurs that you need to alter the form or incorporate additional sections to complete. If you need to enhance Get Millennium Trust Company IRA Distribution Request 2012 before submitting it, the most effective approach is to utilize our robust yet easy-to-use online editing tools.

This all-encompassing PDF editing application permits you to swiftly and effortlessly complete legal documents from any device connected to the internet, make essential adjustments to the template, and add more fields for completion. The service allows you to designate a specific space for each data category, such as Name, Signature, Currency, and SSN and so forth. You can set these as mandatory or conditional and determine who should complete each field by assigning them to a specific recipient.

Follow the steps below to enhance your Get Millennium Trust Company IRA Distribution Request 2012 online:

Our editor is a flexible multi-functional online solution that can assist you in promptly and effortlessly refining Get Millennium Trust Company IRA Distribution Request 2012 and other templates according to your requirements. Enhance document preparation and submission efficiency and ensure that your paperwork appears impeccable without difficulty.

- Open the necessary file from the archive.

- Fill in the gaps with Text and utilize Check and Cross tools on the tick boxes.

- Leverage the right-side toolbar to modify the form with new fillable sections.

- Select the areas based on the type of information to be gathered.

- Set these fields as mandatory, optional, and conditional and personalize their sequence.

- Allocate each section to a specific party using the Add Signer feature.

- Verify that you have made all the necessary alterations and click Done.

Get form

To claim IRA withdrawals on your taxes, utilize Form 1099-R to report the total distributions you received. Ensure that you include these amounts in your taxable income section of your tax return. Following this process helps you meet your tax obligations accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.