Get Fannie Mae 3271 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae 3271 online

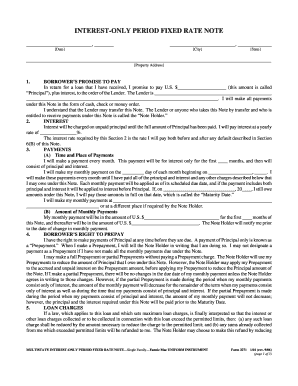

Completing the Fannie Mae 3271 form online is a straightforward process that ensures accurate representation of your loan agreement. This guide will take you through each section of the form, providing detailed instructions to help you navigate the online submission with confidence.

Follow the steps to complete the Fannie Mae 3271 form efficiently

- Click the ‘Get Form’ button to access the form and open it in an online editor.

- Fill in the date, city, and state at the top of the form. Ensure you enter the correct information to avoid any administrative issues.

- In the property address section, provide the complete address of the property associated with the loan. This section is crucial for identifying the property tied to your agreement.

- For the borrower's promise to pay, enter the principal amount you have received. This should match the total loan amount, so double-check for accuracy.

- Indicate the lender's name clearly and accurately, ensuring that all details are correct to avoid confusion in future transactions.

- Specify the yearly interest rate. Make sure to write it in percentage format as it will affect the calculations for your payments.

- In the payments section, determine the duration for which the payments will be interest-only and fill in the payment amounts for both the interest-only phase and the principal and interest phase afterward.

- In the borrower's right to prepay section, familiarize yourself with the terms regarding early payments. Although no specific input is required here, it is important to understand your rights.

- Review the loan charges section to ensure awareness of any maximum charges applicable, making sure everything aligns with existing laws.

- Confirm the late charge terms under the borrower's failure to pay section and understand what your obligations are if payments are missed.

- Fill in any additional details required by the form, such as signatures and dates near the end of the document. Make sure all parties involved provide their signatures where necessary.

- Once all fields have been carefully filled out, you will have the option to save changes, download a copy, print the form for your records, or share it with relevant parties.

Begin your submission process for the Fannie Mae 3271 form online today to ensure your loan agreements are processed smoothly.

Fannie Mae does not provide direct loans to consumers. Instead, Fannie Mae works with lenders to create mortgage products that meet various needs. Essentially, Fannie Mae helps borrowers obtain financing through approved lenders. To better understand your financing options, explore the resources offered by US Legal Forms to streamline your mortgage paperwork.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.