Loading

Get Fannie Mae 1038 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae 1038 online

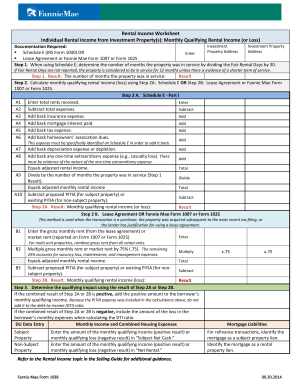

The Fannie Mae 1038 form is an essential document for reporting rental income from investment properties. This guide provides clear and step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the Fannie Mae 1038 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This enables you to access the Fannie Mae 1038 document for completion.

- Identify the investment property to report. Gather necessary documentation, such as Schedule E (IRS Form 1040) or the lease agreement, as required.

- When using Schedule E, determine the number of months the property was in service. Divide the fair rental days reported by 30. If fair rental days are not reported, assume 12 months unless otherwise noted.

- Calculate the monthly qualifying rental income (or loss) using either Step 2A (Schedule E) or Step 2B (lease agreement or Fannie Mae Form 1007 or 1025).

- For Step 2A, enter the total rents received, subtract total expenses, and then add back specified expenses such as insurance, mortgage interest, tax expense, and homeowners' association dues. Finally, divide by the number of months the property was in service to determine the adjusted monthly rental income.

- For Step 2B, enter the gross monthly rent or market rent and multiply by 75%. Then subtract proposed or existing PITIA. This will summarize the adjusted monthly rental income.

- Determine the qualifying impact by reviewing the results from either Step 2A or Step 2B. If the result is positive, add it to the borrower’s monthly qualifying income; if negative, include the loss in the borrower’s monthly expenses.

- Enter the monthly qualifying income or loss into the appropriate sections for subject and non-subject properties in the digital form.

- Finally, review your entries for accuracy. Save your changes, download the completed form, print it, or share it as needed.

Complete your documents online to ensure efficiency and accuracy.

The best way to calculate rental income is by keeping accurate records of all income and expenses related to rental properties. Use a straightforward formula and follow the Fannie Mae 1038 guidelines. Keeping everything organized simplifies the process, making your mortgage application more appealing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.