Loading

Get Form 50 135

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 50 135 online

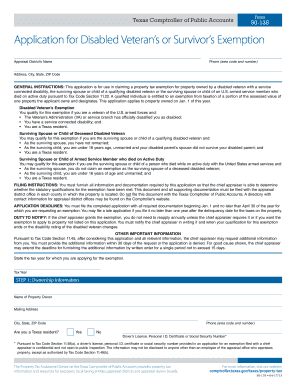

This guide will provide comprehensive, step-by-step instructions on how to fill out the Form 50 135 online, which is used to apply for a property tax exemption for disabled veterans or their surviving family members. Whether you are unsure about certain sections or need assistance in understanding the requirements, this guide is here to help you through the process.

Follow the steps to successfully complete your application

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online editor.

- Fill in the ownership information. Provide your name as the property owner, your mailing address, and your city, state, and ZIP code. Include your phone number and indicate if you are a Texas resident by selecting 'Yes' or 'No'.

- Enter your driver’s license number, personal I.D. certificate number, or social security number. Remember, this information is confidential and protected under law.

- Complete the property information section by providing the address of the property in question, including city, state, and ZIP code. If known, include the legal description and appraisal district account number. If applicable, also specify details about any manufactured home, including its make, model, and identification number.

- Select the type of exemption you are applying for by checking the appropriate box: the disabled veteran’s exemption, the surviving spouse or child of a deceased disabled veteran, or the surviving spouse or child of a U.S. armed service member who died on active duty. Attach any necessary documentation from the VA or service branch showing your latest disability rating.

- If you are submitting a late application, check the box indicating your eligibility for the previous year’s exemption and enter the prior tax year.

- In the final section, sign the form to certify that all provided information is true and accurate. Keep in mind that false statements could have legal consequences.

- After completing all sections, save your changes, download a copy of the form, print it, or share it as required for further submission to the appropriate appraisal district office.

Complete your Form 50 135 application online today to secure your property tax exemption.

The disabled veteran must be a Texas resident and must choose one property to receive the exemption. In Texas, veterans with a disability rating of: 100% are exempt from all property taxes. 70 to 100% receive a $12,000 property tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.