Loading

Get Ia 177

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 177 online

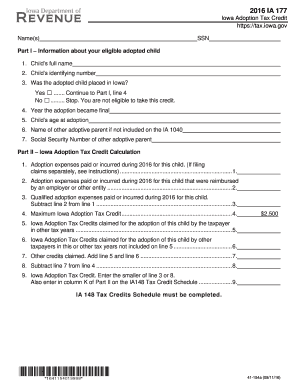

The Ia 177 form is an essential document for individuals claiming the Iowa Adoption Tax Credit. This guide provides clear, step-by-step instructions to help you effectively complete the form online.

Follow the steps to fill out the Ia 177 form successfully.

- Click 'Get Form' button to access the form and open it in your editor.

- Begin by entering the name(s) of the adoptive parent(s) in the designated field.

- Provide the Social Security Number (SSN) for the adoptive parent(s) as required.

- In Part I, input the child's full name and identifying number, which can include the child's Social Security Number or an identification number if available. If not, leave it blank.

- Indicate if the adopted child was placed in Iowa by checking 'Yes' or 'No'. If you select 'No,' you must discontinue your application as you are not eligible for the credit.

- Enter the year when the adoption became final and the age of the child at the time of adoption.

- If applicable, provide the name and Social Security Number of any other adoptive parent who is not included on the IA 1040.

- In Part II, record all qualified adoption expenses paid or incurred during 2016 for the child.

- If any expenses were reimbursed by an employer or other entity, enter those amounts as instructed.

- Calculate the qualified adoption expenses by subtracting reimbursed expenses from total expenses.

- Refer to the maximum Iowa Adoption Tax Credit, which is $2,500, and input this amount.

- Enter any Iowa Adoption Tax Credits claimed for the adoption of this child in previous tax years.

- Include the Iowa Adoption Tax Credits claimed by other taxpayers for this adoption in earlier years.

- Total the amounts claimed and subtract this from the maximum credit available.

- Finally, input the smaller amount from the qualified expenses or the calculated credit amount in the designated field.

- Once all fields are completed, save your changes, and you may choose to download, print, or share the completed form as necessary.

Start filling out your Ia 177 form online today to take advantage of your Iowa Adoption Tax Credit.

IRS Tax Tip 2022-09, January 18, 2022. Taxpayers who adopted or started the adoption process in 2021 may qualify for the adoption credit. This credit can be applied to international, domestic private, and public foster care adoption. Taxpayers who adopt their spouse's child can't claim this credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.