Loading

Get Refund/rollover Forms - Ndpers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Refund/Rollover Forms - NDPERS online

This guide provides a clear and supportive approach to filling out the Refund/Rollover Forms for the North Dakota Public Employees Retirement System (NDPERS) online. By following these instructions, users can ensure accurate completion of the form.

Follow the steps to successfully complete the Refund/Rollover Forms.

- Press the ‘Get Form’ button to acquire the Refund/Rollover Forms and open it for editing.

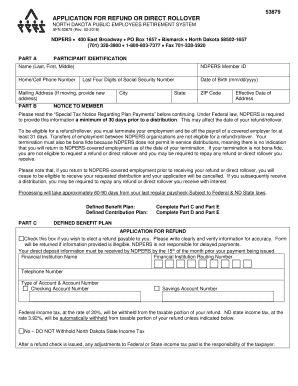

- In Part A, provide your participant identification details. Fill in your name (last, first, and middle), home or cell phone number, NDPERS member ID, last four digits of your Social Security number, and mailing address. Ensure accuracy to avoid processing delays.

- In Part B, review the Notice to Member section carefully. Understand the eligibility requirements for a refund or rollover and confirm that you have terminated employment for at least 31 days.

- Navigate to Part C. If you are applying for a refund from a Defined Benefit Plan, check the appropriate box. Provide your financial institution name, routing number, account type, and account number. Decide on tax withholdings if applicable.

- If requesting a direct rollover, check the relevant box in Part C and include the rollover institution's name and address. Mention the specific amount or percentage of your account to be rolled over.

- In Part D, for a Defined Contribution Plan, indicate your election for a lump sum distribution if necessary and note that a TIAA Distribution Form must accompany this form.

- Complete Part E by providing your signature and date to authorize the transaction. This step is essential for the validity of the form.

- Upon completing the form, save your changes, then download, print, or share it as required.

Start filling out your Refund/Rollover Forms online today.

Your contributions help fund the pension plan, guaranteeing monthly benefits for you and other retired teachers in the future. To qualify for this pension plan, you must first meet the following requirements: Age 65 with five years of service. Rule of 90 (your age and service years must add up to 90)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.