Loading

Get Rp 425 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

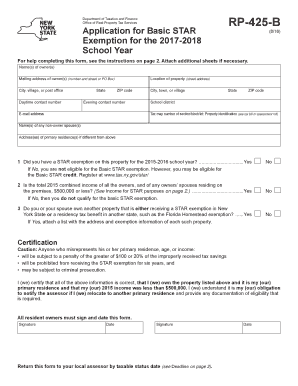

How to fill out the Rp 425 B online

This guide provides users with clear and comprehensive instructions for completing the Rp 425 B form online. Whether you are a first-time applicant or need a refresher, this resource is tailored to meet your needs.

Follow the steps to complete the Rp 425 B form successfully.

- Click the ‘Get Form’ button to obtain the Rp 425 B form and open it in your preferred online editor.

- Fill out the section labeled 'Name of owner(s)'. Provide the full name of the person or people who own the property. Ensure that you use proper capitalization.

- Enter the 'Mailing address of owner(s)', including the number and street or PO Box. Include city, village, or post office, and state.

- Input the 'Location of property' section. Write the exact street address of the property for which you are claiming the exemption.

- In the 'ZIP code' field, enter the correct ZIP code associated with the property address.

- Complete the 'Daytime contact number' field with a contact number where you can be reached during business hours.

- Provide the 'Evening contact number' in the same manner, ensuring a reliable way for officials to contact you.

- Fill in the 'School district' by selecting the appropriate school district for the property.

- Under 'Tax map number', include the number that identifies the parcel of property (found on the tax bill or assessment roll).

- Indicate if you have a Basic STAR exemption on this property for the applicable school year by selecting 'Yes' or 'No'.

- If applicable, provide details for any additional owner or spouse, including their name and address.

- Complete the 'Income statement' section where you may need to prove that the combined income of all owners and spouses is below a certain amount.

- Sign and date the form at the bottom. All resident owners must provide their signatures to validate the application.

- Finally, return this form to your local assessor by the taxable status date, ensuring timely submission.

Complete your Rp 425 B form online today to take advantage of the exemption!

Age eligibility Each of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or. siblings (having at least one common parent) and. one of the owners is at least 65.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.