Loading

Get Maximus Tax Credit Questionnaire Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maximus Tax Credit Questionnaire Form online

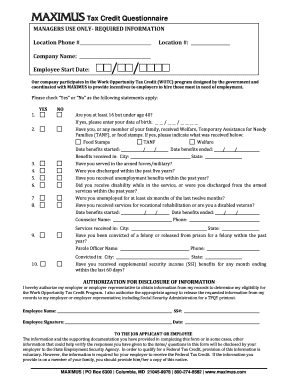

The Maximus Tax Credit Questionnaire Form is crucial for determining eligibility for the Work Opportunity Tax Credit program. This guide provides detailed, step-by-step instructions to assist users in completing the form online clearly and accurately.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form. This will allow you to access the form in an editable format.

- Fill in the required manager information at the top of the form. Include the location phone number, company name, and the employee's start date, as well as the location number.

- Proceed to the questions regarding personal qualifications. Respond to each statement by checking either 'Yes' or 'No'. If you answer 'Yes' to being under age 40, provide your date of birth in the format indicated.

- For questions related to welfare benefits, such as food stamps and TANF, detail any relevant information including dates started and ended, and the city and state where benefits were received.

- If applicable, indicate your armed forces service status and whether you have received any unemployment benefits or disability within the past year.

- Complete the section about felony convictions, providing the necessary details if applicable, including the name and phone number of your parole officer if required.

- In the authorization section, provide your name, Social Security number, and signature to grant permission for your employer to access needed information for eligibility verification.

- Review all entered information for accuracy. After verifying that everything is correctly filled out, you can then save changes, download, print, or share the completed form as necessary.

Complete your Maximus Tax Credit Questionnaire Form online today for a streamlined application process.

The Work Opportunity Tax Credit (WOTC) can help you get a job. If you are in one of the “target groups” listed below, an employer who hires you could receive a federal tax credit of up to $9,600.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.